Jatin Joshi

From digital health adoption to the rise of new healthcare business models, the sector is undergoing a shift that affects hospitals, diagnostic centres, insurers, and even wellness brands. The pandemic accelerated many of these changes, but the real transformation is happening now—driven by policy reforms, private investments, and a more informed, digitally connected patient base.

With India’s healthcare market projected to reach $650 billion by 2025, the government and private players are making significant strides in digitisation, infrastructure expansion, and insurance penetration. However, beyond numbers, what does this mean for patients, providers, and businesses operating in healthcare?

1. Digital Healthcare 2.0: From Adoption to Optimization

The first wave of digital healthcare adoption in India focused on creating basic digital infrastructure—such as the Ayushman Bharat Digital Mission (ABDM), which introduced 468 million digital health IDs (ABHA), and the COWIN platform, which enabled over 2 billion COVID-19 vaccinations. But these systems were largely reactive, built in response to the pandemic.

Now, the focus is shifting toward integration and optimisation. In 2023, the government expanded the National Health Digital Ecosystem to allow seamless sharing of electronic medical records across hospitals and insurance providers, improving continuity of care. Several states, including Tamil Nadu, Karnataka, and Maharashtra, have already linked their healthcare facilities to ABDM, making patient histories accessible across networks.

For private hospitals and healthcare marketers, this shift brings both challenges and opportunities. Online patient engagement is no longer a luxury—it’s an expectation. Providers must now ensure their digital presence aligns with government frameworks while also offering personalized, patient-friendly services.

2. Healthcare’s Next Growth Market: Tier-2 and Tier-3 Cities

For years, the Indian healthcare system was heavily urban-centric, with top hospitals concentrated in metro cities. But this is changing. The next wave of healthcare expansion is happening in Tier-2 and Tier-3 cities, driven by two key factors:

- Infrastructure investments: The Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM-ABHIM), launched in 2021, is rolling out 157 new medical colleges and strengthening primary care facilities in smaller cities.

- Private sector growth: Leading hospital chains like Apollo, Fortis, and Manipal are expanding into non-metro cities, with investments in day-care centers, diagnostic hubs, and telemedicine-supported clinics.

For healthcare marketers, this means reaching beyond traditional urban demographics. Digital-first patient engagement strategies, regional language content, and trust-building initiatives will be key to tapping into these emerging markets.

3. Health Insurance Boom: The Shift Toward Outpatient and Preventive Coverage

India’s health insurance sector is undergoing a massive shift, with IRDAI (Insurance Regulatory and Development Authority of India) pushing for ‘Insurance for All by 2047’. The biggest change? Insurance is moving beyond hospitalisation coverage.

- Outpatient and preventive care: New-age insurers like Niva Bupa, ICICI Lombard, and Plum Insurance are offering policies covering OPD consultations, diagnostics, mental health therapy, and chronic disease management.

- Cashless claims beyond hospitals: In early 2024, IRDAI mandated insurers to expand cashless services to primary care centers, pharmacies, and diagnostic labs, reducing out-of-pocket expenses for patients.

- Health-tech integrations: Platforms like Digit, ACKO, and Tata AIG are integrating with digital health records, offering faster claims processing and AI-driven policy recommendations.

For healthcare providers, this means a shift in patient expectations—more people will seek preventive care, digital health consultations, and alternative treatments covered under insurance. Hospitals, diagnostic centres, and wellness brands must align their offerings with these new policies to remain competitive.

4. The Next Phase of Telemedicine: From Virtual Consults to Hybrid Healthcare

Telemedicine skyrocketed during COVID-19, but 2024 is shaping up to be the year of hybrid healthcare—a model that blends virtual consultations with in-person care.

- eSanjeevani, India’s flagship teleconsultation platform, has now facilitated 140 million online doctor consultations, with AI-backed triage tools improving patient management.

- Private players like Practo, 1mg, and Apollo 24/7 are expanding their “phygital” (physical + digital) models, combining teleconsults with home diagnostics and medicine delivery.

- WhatsApp-based healthcare is gaining traction, with doctors offering video consults and follow-ups directly through messaging platforms.

For clinics and hospitals, integrating telehealth into their practice is no longer optional. The challenge is ensuring a seamless patient experience across online and offline touchpoints.

5. The Rise of Wellness and Holistic Health in Mainstream Healthcare

The Indian healthcare system is witnessing a convergence of traditional and modern medicine. Ayurveda, yoga, and holistic therapies—once considered niche—are now entering the mainstream.

- The WHO Global Centre for Traditional Medicine, launched in Jamnagar, Gujarat, in 2022, is set to boost research and integration of Ayurveda with conventional healthcare.

- Hospital chains like Apollo and Max now offer integrative medicine departments, combining allopathy with traditional healing methods.

- Corporate wellness programs have expanded to include mental health support, nutritional counseling, and digital wellness tracking.

For brands in the wellness space, this presents new opportunities to market preventive healthcare solutions beyond traditional medicine. From Ayurveda-based nutraceuticals to corporate wellness tech, this sector is ripe for innovation.

6. The Evolving Role of Healthcare Marketing: Trust, Transparency, and Digital Discovery

Perhaps the most significant transformation in Indian healthcare isn’t medical—it’s how patients discover, choose, and trust healthcare providers.

- Google searches for healthcare queries in India have increased by 85% since 2021, with patients relying on reviews, testimonials, and digital word-of-mouth to make decisions.

- The Competition Commission of India (CCI) is cracking down on misleading healthcare advertising, making transparency in pricing and outcomes more critical than ever.

- Hospitals and clinics must now focus on building credibility through patient education, content marketing, and verified reviews rather than hard-selling services.

Conclusion

India’s healthcare future isn’t just about technology and infrastructure—it’s about accessibility, affordability, and patient trust. While hospitals and diagnostic centres continue to evolve, the real game-changer is how healthcare is delivered, marketed, and experienced.

For providers, insurers, and wellness brands, success in the coming years will depend on embracing digital engagement, adapting to new consumer expectations, and ensuring seamless, patient-friendly experiences—both online and offline. As the sector moves forward, the challenge will not just be in offering healthcare but in making it more personalized, transparent, and patient-centric than ever before.

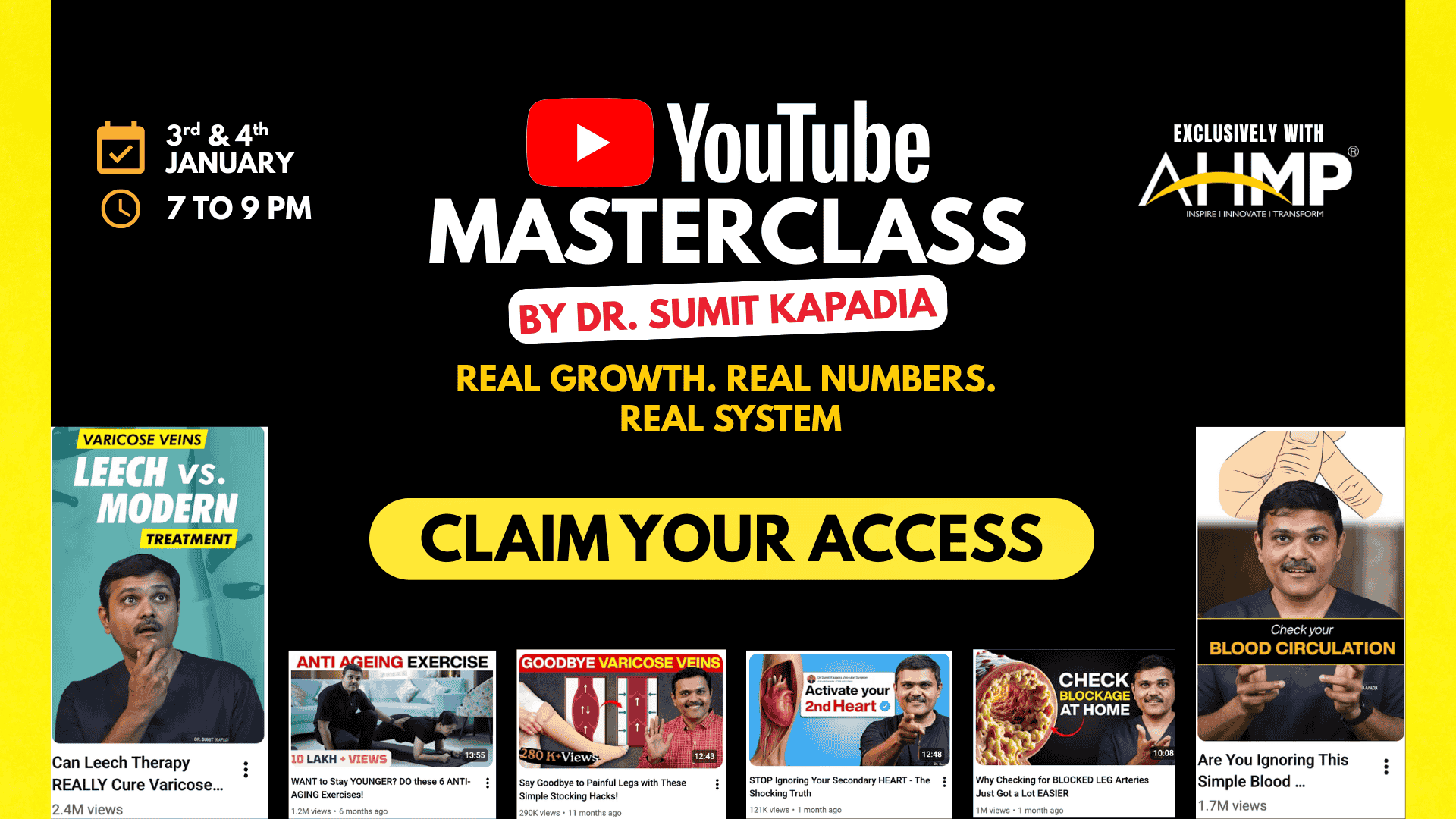

YouTube Masterclass for Doctors | Live Online Training January 2026

A live online YouTube training program for doctors to build online credibility, digital visibility and patient education using video.

AHMP Drift Tribe – Udaipur Edition

Join AHMP Drift Tribe – Udaipur Edition, a four-day collective of accomplished minds. Step away from deadlines into mindful mornings, candid conversations, and meaningful connections that outlast the weekend.

Branding from the Inside Out: How Healthcare Facilities Can Win Hearts and Minds

Behavioural targeting in healthcare marketing enables personalised, data-driven campaigns that boost engagement and outcomes. Learn how to hit the bullseye ethically.

Bullseye Marketing: How Behavioural Targeting Hits the Mark in Healthcare Campaigns

Behavioural targeting in healthcare marketing enables personalised, data-driven campaigns that boost engagement and outcomes. Learn how to hit the bullseye ethically.

Health Care Marketing and Budget

Healthcare marketing is key to building patient trust and driving growth. Learn how to smartly allocate your budget across digital, content, and outreach strategies.

The Secret Weapon for Small Clinics: How Hyperlocal Marketing Can Fill Your Appointment Calendar

Struggling to compete with big hospitals? Discover how small clinics can win more patients using hyperlocal marketing—low-cost, high-impact strategies that target your neighborhood.